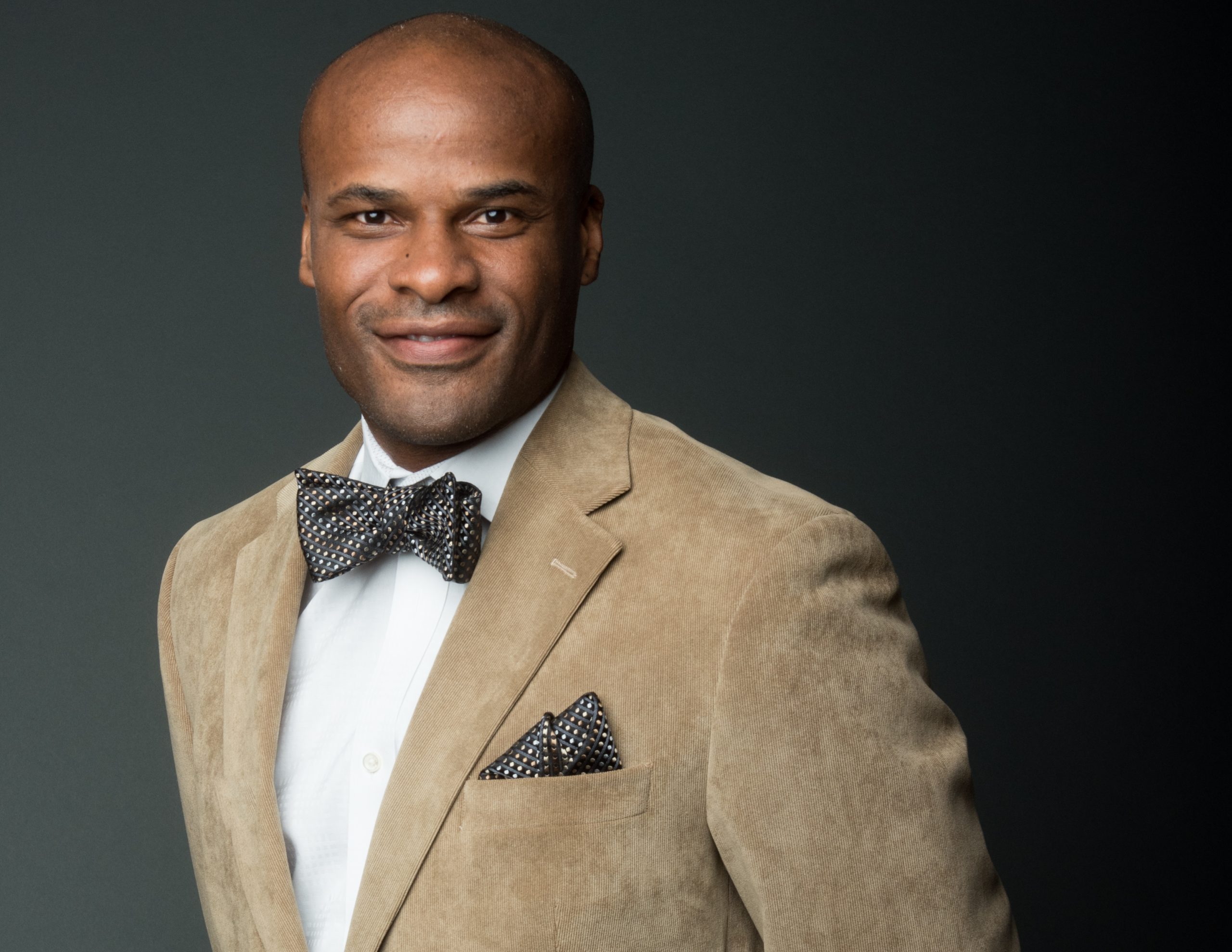

Tod Long, Independent Advisor

Tod Long didn’t set out to become an insurance agent. In fact, he was skeptical when his father first suggested it. But after working with real clients and seeing how the right planning decisions could materially change their futures, his perspective shifted.

What began as a career became a craft—helping people make better financial decisions at critical moments in their lives. With a background in competitive athletics, Tod brought a discipline-first mindset to retirement planning, focused on preparation, sequencing, and long-term outcomes rather than quick wins.

Today, Tod specializes in helping individuals and families approach retirement with clarity, confidence, and control—so decisions are made intentionally, not reactively.

Tod Long, Host of Financial Fast Track Radio

Tod Long brings over two decades of experience helping families plan for retirement with clarity and confidence. A former University of Oklahoma track star and professional Nike sprinter, Tod carries the discipline, resilience, and focus of the track into every conversation about wealth and retirement planning.

As host of Financial Fast Track Radio, Tod’s mission is simple: help listeners get “on track” for life’s financial journey. Each week, he and his co-host break down complex retirement topics—Social Security, taxes, annuities, investments—into clear, actionable strategies that help retirees and pre-retirees protect their income, minimize risk, and build lasting financial security.

Strategy-led retirement income planning

Long Financial Services

Retirement planning isn’t about choosing products—it’s about making the right decisions, in the right order, with full awareness of the tradeoffs involved.

At Long Financial Services, we bring more than two decades of experience helping individuals and families navigate complex retirement transitions. Our focus is not on transactions, but on clarity, sequencing, and long-term reliability—especially at the moments when mistakes are hardest to unwind.

We take a deliberately consultative approach, working one-on-one with clients to understand their goals, risks, and constraints before recommending any course of action. Every strategy is tailored, pressure-tested, and designed to reduce uncertainty—not introduce it.

Unlike firms that lead with products or generic plans, we emphasize disciplined planning, thoughtful decision-making, and solutions that fit your situation—not the other way around.

Retirement Guidance

At Long Financial Services, we provide clear, experienced guidance focused on retirement income, risk management, and long-term financial security. Our approach helps you understand your options, weigh tradeoffs, and make confident decisions that align with how you want to live in retirement.