Our History

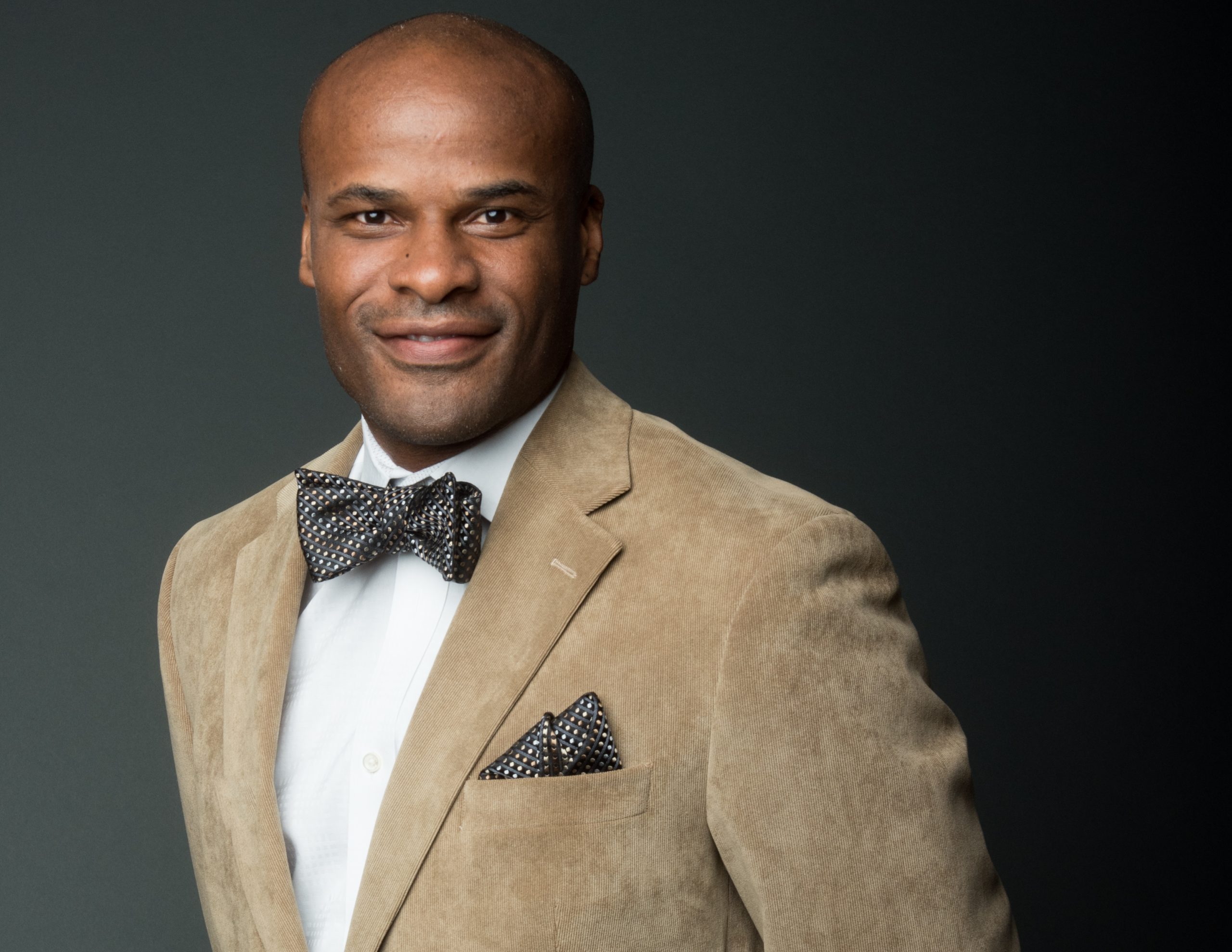

Tod Long is a retirement income strategist with more than two decades of experience helping individuals and families make confident, durable financial decisions as they approach and enter retirement.

He did not begin his career intending to work in insurance. In fact, Tod was initially skeptical when introduced to the industry. That skepticism ultimately became an advantage. Rather than approaching planning from a product-first mindset, he developed a disciplined, strategy-led approach—focused on understanding tradeoffs, sequencing decisions correctly, and reducing avoidable risk at critical life transitions.

Since 2003, Tod has worked with more than 3,000 clients across 46 states, helping them navigate retirement income planning, risk management, tax-aware decision-making, and long-term financial clarity. His work is especially focused on individuals nearing retirement who want predictability, control, and confidence—not speculation or complexity.

Tod’s background as a competitive athlete shaped the way he approaches retirement planning. He understands that outcomes are rarely determined by a single decision, but by preparation, timing, and execution under pressure. That perspective carries through every engagement: careful analysis first, clear strategy next, and only then thoughtful implementation.

At Long Financial Services, Tod’s role is not to push products or rush decisions. His role is to help clients slow down, evaluate their options, understand the consequences of each path, and move forward with intention. Many of the decisions faced in retirement—income timing, guarantees, tax exposure—are difficult or impossible to reverse. Tod’s work is designed to ensure those decisions are made with clarity rather than urgency.

Tod’s guiding objective is simple: to help clients reach retirement with a plan they understand, confidence in the decisions they are making, and the freedom to work—or not work—on their own terms.